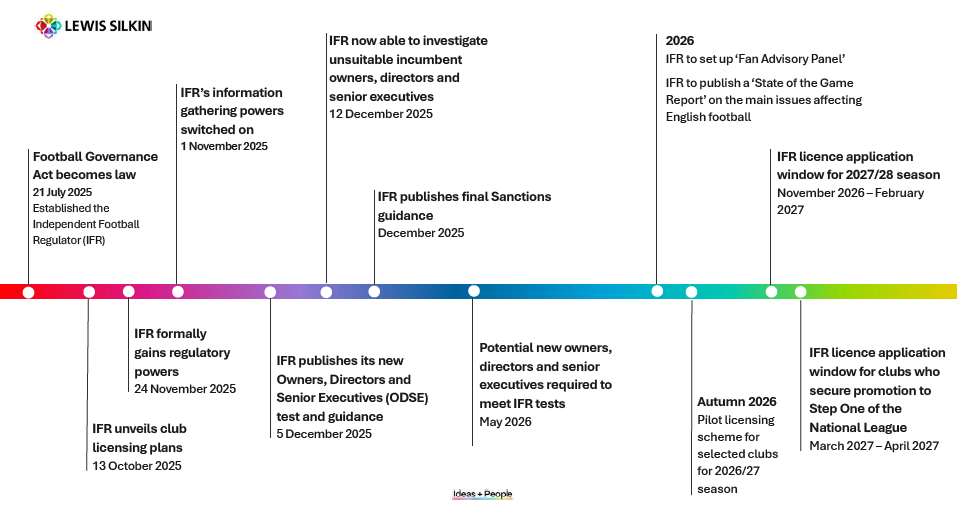

English football has entered a new era. In July 2025, after a long journey set in motion by the attempted breakaway European Super League and the Fan-Led Review led by Tracey Crouch MP, the Football Governance Act came into force. It established a new Independent Football Regulator (IFR) in a landmark moment for the sport, designed to protect clubs nationwide by raising standards and securing the game's financial sustainability. With a string of recent near-financial collapses, think Bury, Macclesfield Town, Derby County, and Reading, the stakes could hardly be higher. From the 2027/28 season, every club must be licensed by the IFR and meet ongoing requirements to keep that licence, with a provisional licence approval process to be conducted for selected clubs during the 2026/27 season.

A cornerstone of the IFR's new licensing regime is a stronger statutory Owners, Directors and Senior Executives (ODSE) test. Its aim is to ensure club custodians are suitable, financially sound and not relying on illicit financing. The regulator also has powers to force the sale of a club if an owner proves unfit, a backstop designed to safeguard the clubs and the communities they serve.

Who is caught by the rules?

The ODSE Test applies to two groups:

- "Owners", including anyone who owns more than 25% of the shares or voting rights, or who otherwise has significant influence or control - even indirectly, through companies, trusts or similar arrangements; and

- Individuals in one of the six Senior Management Functions (SMFs): Chair, Chief Executive, Chief Finance, Chief Operations, Director (including shadow directors), and Other Key Decision Makers (which captures those who, even if not on the board, have real sway over the club's management or regulated activities). For this note, we'll call these people "Senior Managers".

Interestingly, the new ODSE test closely mirrors the Financial Conduct Authority's Senior Managers Regime. At its core is the familiar "fit and proper" standard, now applied squarely to football club leadership. Misconduct is classified into three levels of seriousness with sanctions set to reflect the gravity of the breach.

This article is focused on the test and implications for SMF roles. For how the new test applies to owners and clubs, see our separate article here.

People in or considering SMF roles need to take this seriously. The obligations and significant sanctions apply not only to the regulated club, but also to the individuals taking up the role.

From when is it in force?

The new ODSE test has applied to incumbent owners and Senior Managers (i.e. those already in the role) since 12 December 2025.

Assessments for new owners and Senior Managers are expected to begin in May 2026.

What do clubs and individuals have to do?

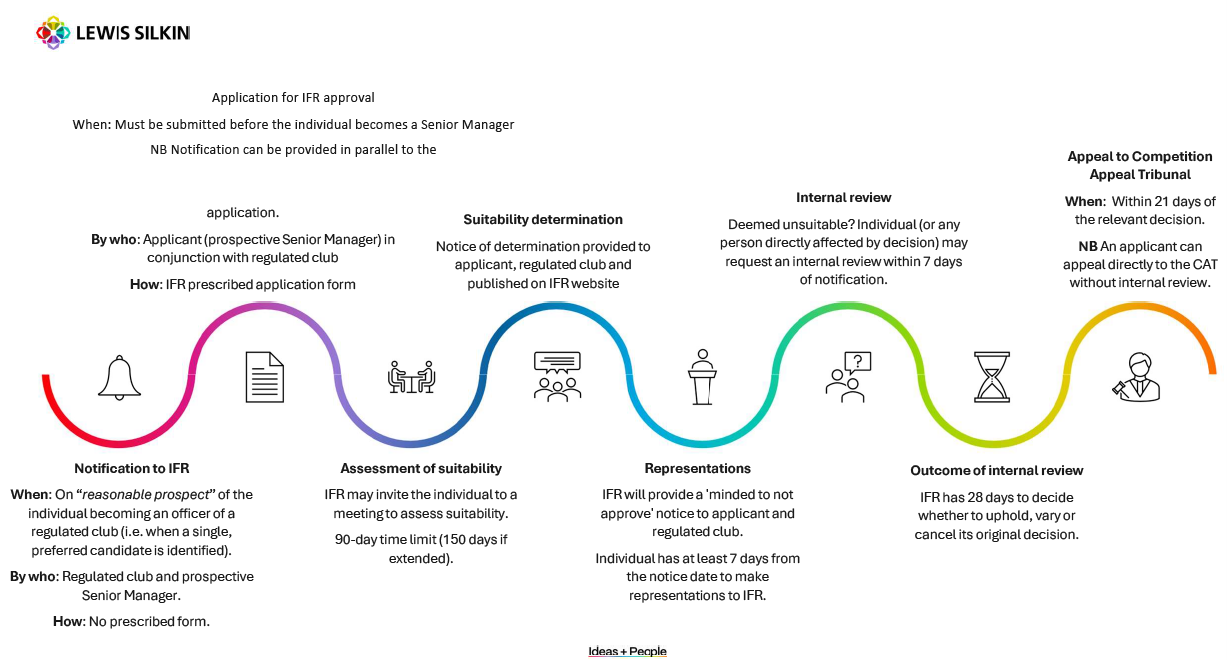

The regime turns on transparency, approval and ongoing accountability. Clubs and individuals must notify the IFR when there is a "reasonable prospect" that someone will become an owner or step into an SMF role. For Senior Managers, some comfort for clubs will be that this is only likely to be triggered once the club has identified a single preferred candidate rather than at the shortlisting stage, meaning clubs will not need to submit multiple forms covering all potential candidates. A more detailed application, in the IFR's prescribed form, must also be submitted to the IFR in respect of the candidate. No one can take up ownership or an SMF position until this formal application is submitted and the IFR has decided they are suitable for the role.

Suitability means different things depending on the role, but the themes are consistent. Those in SMF roles must demonstrate honesty and integrity and financial soundness. They must also satisfy the regulator that they are competent for the specific job at hand.

What does "fit and proper" look like in practice?

Honesty and integrity

The IFR will look at a wide set of factors when assessing honesty and integrity. That includes criminal matters (even if the conduct happened outside the UK), findings from courts or tribunals, past regulatory or disciplinary action, immigration and sanctions status, and whether a person has misled or failed to cooperate with regulators or governing bodies. It is a holistic assessment, not a tick‑box exercise – we wait to see how non-financial misconduct (e.g. harassment or bullying) will be treated given the recent work the FCA has done in this area, however we expect there to be significant parallels.

Financial soundness

Financial soundness will be assessed equally broadly. Personal insolvency events will naturally matter. So too will the financial health or insolvency of organisations where the individual held responsibility. If someone has had a hand in financial mismanagement elsewhere, that history will attract scrutiny.

Competence

Competence will be considered in context of the role applied for. Football experience will help but is not mandatory. What matters is whether the person has the skills and track record for the specific SMF role in the circumstances of the club. The IFR will also look at how the club went about its hiring - was there a rigorous process, or was the candidate approved with minimal scrutiny?

What happens after a Senior Manager is approved?

Approval is not a one‑and‑done event. Crucially, the IFR can reassess suitability if it receives information raising grounds for concern or suspicion (which in addition to the regulatory context opens up a new potential set of risks for whistleblowing claims). If, after a fair process, the IFR decides that a Senior Manager is no longer suitable for their role, it can remove or ban that person or impose "conduct requirements" that limit what they can do at the club. Decisions are notified and published, and there are routes to challenge them through internal review and, where appropriate, appeal to the Competition Appeal Tribunal.

There is also a continuing duty to disclose. Clubs and individuals must notify the IFR as soon as reasonably practicable if something material changes that could affect suitability.

So, what does this mean for clubs?

Clubs must make sure Senior Managers meet and continue to meet the suitability standards. If they don't, there's a real risk of disruption if they are removed, disqualified, or have their powers limited (and the IFR has an extensive toolkit to do so) - which can affect everything from a club's finances to its strategy and day‑to‑day operations. And as we all know, success on the pitch isn't just about talent or form on the day, it's underpinned by the club's wider plan and how well it's run behind the scenes.

So how do clubs reduce the risk? A practical step will be to build the right protections into the employment contracts of anyone taking on a SMF and that regular checks and training are undertaken. In simple terms, that means ensuring suitability checks are completed before they start, and that SMFs commit to, and are held accountable for, ongoing compliance with their obligations.

Clubs should therefore already have started doing the following:

- Clarifying if a role is within scope of ODSE rules. Ideally, an individual's employment contract or service agreement will clearly state if they hold or may be expected to hold a SMF and make it explicit that they must meet their duties under the Football Governance Act 2025 and the IFR licensing regime on commencement and on an ongoing basis. We may also start to see responsibility maps as in the financial services sector.

- Making job offers or promotions into SMF roles conditional. State in offer letters that the role is conditional on IFR approval, and that continued employment depends on keeping that approval.

- Strengthen disclosure duties. Require upfront and ongoing disclosure of any criminal or civil proceedings, regulatory or disciplinary action (including director disqualification), sanctions or immigration issues, personal insolvency or financial difficulties, and any insolvency or financial distress at organisations where the individual had responsibility.

- Require co‑operation with the regulator. Include contractual clauses, as well as policies, requiring timely, complete responses and consent to information‑sharing with the IFR, including attending meetings and allowing third‑party checks that the IFR may run. Clubs should also encourage staff to self-report concerns internally.

- Build in competence standards. Require the employee to maintain role‑appropriate qualifications / experience / training and undertake training reasonably required to meet IFR expectations.

- Align termination rights. Include a clear right to terminate employment or remove a director if the IFR revokes a senior manager's approval or the club has reasonable grounds to believe that they will revoke approval.

- Investigation processes: Consider establishing protocols for reporting and/ or investigating alleged or potential breaches, including developing frameworks for how investigations will be conducted, by whom, who they will report to and who has oversight for them.

Sanctions for Senior Managers

Senior Managers should recognise the personal risks of breaching the IFR's rules, particularly in relation to cooperating with the regulator.

Sanctions may be imposed for a range of infringements. These include failing to notify the IFR that an individual is a prospective new Senior Manager, failing to notify changes in circumstances affecting a person's suitability to be a Senior Manager, and failing to comply with any rule made by the IFR.

Separately, failure to comply with an information request, the destruction or falsification of records, or the provision of information that is false or misleading can each lead to enforcement action. The latter two are particularly serious and may constitute criminal offences, (with penalties of up to two years' imprisonment).

The personal financial exposure can also be significant. For Senior Managers, a fixed penalty can be set at the higher of 10% of total remuneration or £75,000. A daily penalty can be set at the higher of 10% of daily pay or £25,000 per day. Crucially, these penalties are imposed on the individual who provided the false or misleading information, not on the club.

It remains to be seen whether the IFR will directly enforce sanctions against individuals. At least initially, the IFR is likely to present itself as a friendly and collaborative regulator that works with clubs and individuals to resolve issues. However, in serious cases we expect the IFR to pursue clubs and individuals for non-compliance with its rules without hesitation.

Top tips for senior managers

- Be candid with the IFR and your club – report, report, report. Do not mislead, omit, or downplay issues. If in doubt, disclose - reporting is the safest bet. Engage early, respond fully and on time, and keep a clear, consistent narrative across your submissions, interactions with the IFR and any public statements.

- Maintain your competence. Be honest about any gaps in your experience or qualifications. Where needed, undertake appropriate training to close those gaps and ensure you continue to meet the competency requirements of your role. Keep a record of all training completed.

- Integrity is key. Maintain honesty and integrity in all dealings with the IFR, the club and its stakeholders. This includes transparency in financial reporting and decision-making.

Looking for practical guidance on how the new ODSE rules affect your club and how to stay protected? Get in touch with your usual Lewis Silkin contact or speak to a member of our Employment team.