Following a consultation paper in June 2023 and draft legislation in July 2025, these changes should come as no surprise to most businesses.

The new legislation requires businesses using umbrella companies to perform greater due diligence on their supply chains to ensure tax compliance. While well intended, this is likely to increase the compliance burden on businesses already feeling the strain.

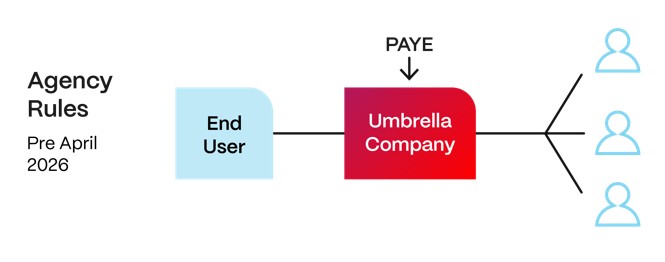

What is an umbrella company and what are the rules today?

An umbrella company is an intermediary entity that engages individuals, typically as employees, to provide services to clients.

The umbrella company is responsible for administration relating to the workers and, at present, is responsible for the correct operation of PAYE and NICs.

Because of this, they are often engaged to outsource employment tax compliance and risk.

What changes from 6 April 2026?

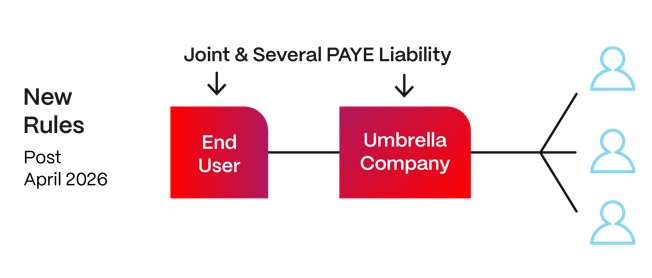

From 6 April 2026 the client and the umbrella company will each be jointly and severally liable for the PAYE and NICs due on payments to the worker. This means HMRC may pursue either party for the full amount, with that party then seeking contribution or reimbursement from the other. The client will therefore be potentially liable for the failed compliance of another party in the “contractual chain”.

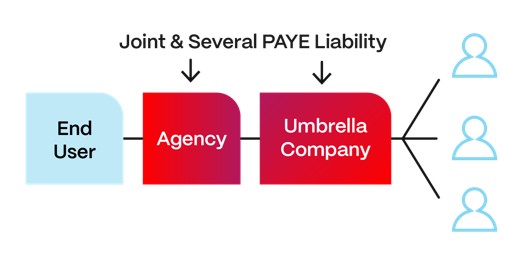

One nuance to the rules is that where there is another party in the contractual chains (e.g., an agency), it is generally the contractual party "above” the umbrella company that is jointly and severally liable with the umbrella company, and not the client.

There are anti-avoidance provisions that state that these rules will apply if the worker is not employed by the umbrella company, but the worker is essentially providing services under what is in substance an employment relationship (i.e., they will look through artificial arrangements that seek to circumvent these rules).

Employers of record

Employers of record or “EORs” act as employing agents, employing workers on behalf of clients and supplying their services to end users under a commercial arrangement.

They therefore fall squarely within the new definition of an “umbrella company”.

Clients who use EORs should therefore be aware that they could be on the hook if the EOR fails to operate payroll correctly. Further, as alluded to above, if there are parties in the contractual chain that are not UK resident, a client may find itself liable for unpaid tax where it may not otherwise expect to be.

Interaction with other rules like IR35

These rules sit alongside the existing “off payroll worker” rules, IR35 and other labour supply chain obligations (for example, the requirement to provide agency workers with information on vacancies and access to certain facilities).

Businesses should therefore integrate the new responsibility with their processes that cover contingent workers more generally, including employment status assessments, agency auditing/compliance checks and right to work procedures.

How should businesses respond?

Clients

The important distinction to the changes to the IR35 rules is that where an umbrella company is in play, clients aren’t in control of payments to workers. Clients should therefore ensure they:

- Map supply chains to identify where they could now be liable for unpaid tax under the new rules.

- Assess and review engagements with intermediaries (including EORs), to ensure they are properly registered with HMRC and are complying with PAYE and NIC obligations.

- Have robust due diligence processes in place to ensure any new intermediaries understand their compliance obligations and comply with requirements.

- Review contractual protections to mitigate exposure in the event of non-compliance.

- Carry out ongoing monitoring of arrangements, including periodic audits of payroll records, PAYE submissions and remittances to HMRC.

Engagement across procurement, HR, tax, finance and procurements departments will be important to ensure processes are consistent and well managed. In certain cases, clients might consider tax insurance to mitigate exposure.

Umbrella companies

With clients focussed on ensuring the parties in the contractual chain are compliant with PAYE and NIC rules, there is an opportunity for well organised businesses that provide these services to stand out. Umbrella companies (and any other liable parties) should:

- Clearly demonstrate understanding of how these rules apply on new and existing engagements.

- Be proactive in assisting clients with due diligence and onboarding processes.

- Be transparent about ongoing payroll processes and how compliance is ensured.

We think that umbrella companies that “make life easy” for clients in this way are most likely to be preferred providers.

Can we help?

If you are interested in the other changes affecting umbrella companies and agencies contained within the Employment Rights Act you can access our dashboard here.

Get in touch with me or your usual contact to discuss how this impacts you.